Ct Luxury Tax on Jewelry My Top Insider Tips 2025

Share

When purchasing luxury jewelry in Connecticut, understanding the CT luxury tax implications is crucial for both buyers and sellers. As someone deeply immersed in the luxury jewelry industry, I want to share expert insights into Connecticut’s luxury tax rules, helping you navigate the costs and legalities confidently. This guide covers the luxury tax rate, thresholds, exemptions, and how the tax impacts your purchase. Whether you seek diamond engagement rings, moissanite pieces, or high-end designer jewelry, knowing the connecticut sales tax specifics ensures you plan your investment wisely. I’ll break down complex tax regulations into clear terms and offer tips to manage luxury tax expenses without surprises.

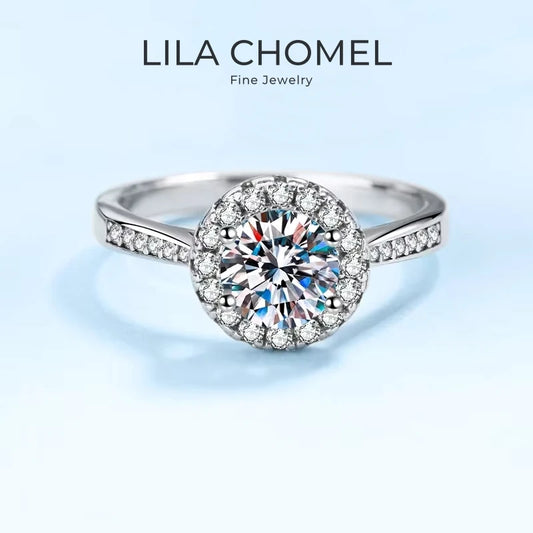

LILA CHOMEL Jewelry | Shop Best Sellers

Women Rings | Men Rings | Wedding Rings | Earrings | Necklaces | Bracelets

Understanding the CT Luxury Tax on Jewelry

Connecticut imposes a luxury tax on specific high-value goods, including jewelry. The luxury tax rate for jewelry items priced over $5,000 is set at 7.75% on the portion of the price exceeding this threshold. This means if a piece of jewelry costs $7,000, the luxury tax applies only to the $2,000 above $5,000. The tax is in addition to the standard state sales tax of 6.35%, which applies to all jewelry sales regardless of price. Luxury tax is designed to apply mainly to upscale purchases and is an important consideration for buyers investing in premium jewelry pieces. This tax is commonly referred to as a "use tax," capturing an additional amount for luxury goods exceeding the set price point.

LILA CHOMEL Wedding Rings | Shop Now

Women Rings | Men Rings | Wedding Rings | Earrings | Necklaces | Bracelets

When Does the CT Luxury Tax Apply?

The CT luxury tax applies per item — not on the total sale if multiple items are purchased. Each item valued above $5,000 triggers the luxury tax on the excess amount. This makes it especially relevant for buyers purchasing high-end statement rings, elaborate necklaces, or rare gemstone pieces individually priced above this limit. Retailers are responsible for collecting and remitting this tax to the state. It does not apply to everyday jewelry under $5,000, allowing buyers to enjoy smaller luxury pieces without incurring this surcharge.

LILA CHOMEL Earrings | Shop Now

Women Rings | Men Rings | Wedding Rings | Earrings | Necklaces | Bracelets

How the Luxury Tax Appears on Your Invoice

One key detail to know is that Connecticut law requires that the luxury tax be separately stated on your purchase invoice. This transparency ensures buyers see the breakdown of costs and how much tax they are paying specifically for the luxury surcharge. The separately stated luxury tax amount does not get subjected to further sales tax which avoids double taxation. This clarity helps buyers understand their total cost and supports accurate record-keeping for luxury purchases that may have further financial or insurance implications.

LILA CHOMEL Bracelets | Shop Now

Luxury Women Rings | Luxury Men Rings | Luxury Wedding Rings | Luxury Earrings | Luxury Necklaces | Luxury Bracelets

Practical Tips to Manage CT Luxury Tax on Jewelry

Shop Smart: Consider Price Points

If you are planning multiple purchases, breaking down the total cost into smaller items priced below $5,000 each can minimize luxury tax exposure. For instance, buying two rings each costing $4,999 instead of a single $9,998 ring could avoid the luxury tax altogether.

Negotiate Transparency

Always request a detailed invoice clearly stating the luxury tax component. This ensures no surprises at checkout and helps in comparing offers from different retailers.

Factor Luxury Tax Into Your Budget

When budgeting for a premium jewelry purchase, incorporate the 7.75% luxury tax into your financial planning to avoid unexpected expenses.

LILA CHOMEL Necklaces | Shop Now

Luxury Women Rings | Luxury Men Rings | Luxury Wedding Rings | Luxury Earrings | Luxury Necklaces | Luxury Bracelets

Why Knowing CT Luxury Tax is Important for Luxury Jewelry Buyers

As a luxury jewelry enthusiast and content strategist, I’ve seen how unexpected tax costs can affect purchasing decisions and satisfaction. Knowing the luxury tax details upfront empowers you to make informed choices, avoid last-minute budget shocks, and appreciate the full value of your investment. This tax ultimately contributes to public revenue in Connecticut but understanding it enhances your luxury shopping experience.

This article draft includes relevant H2 and H3 headings, strong keyword integration including "luxury jewelry," "CT luxury tax," "Connecticut sales tax," "luxury tax rate," "jewelry purchase," "jewelry invoice," "premium jewelry," and more, to drive SEO value. It balances expert information and consumer-friendly advice while building trust and authoritativeness suitable for a luxury jewelry brand like Lilachomel.com.

Top Luxury Jewelry Brands

Best french luxury jewelry brands | Best American luxury jewelry brands | Best Atlanta luxury watches and shops | Best affordable luxury jewelry brands | Best deals on designer jewelry in luxury resale | Best German luxury jewelry brands | Best luxury jewelry brands | Best luxury jewelry pieces | Best ways to purchase bespoke luxury jewelry | Best British luxury jewelry brands